BONDS AND INTEREST RATES - MARKET INFORMATION

Use the table below to find out all you need to know about spread betting on bonds and interest rates with Spreadex.

Use the tab sections to access the market information you require for each product or click on the product name to find a full description of the product.

| Product | Trading Hours^ | Trade Per | Spread Width From*** |

|---|---|---|---|

| Bonds, Futures | |||

| French OAT, Mar | 0015-2100 |

0.01 | 5 |

| German Bobl, Mar | 0015-2100 |

0.01 | 2 |

| German Bund, Mar | 0115-2100 |

0.01 | 2 |

| German Buxl, Mar | 0115-2100 |

0.01 | 8 |

| German Schatz, Mar | 0015-2100 |

0.01 | 2 |

| Japanese Government Bond, Mar | 2300-2200 |

0.01 | 12 |

| Long-Term BTP, Mar | 0705-1800 |

0.01 | 5 |

| UK Long Gilt, Mar | 0800-1800 |

0.01 | 3 |

| US 10 Year Note (Decimal), Mar | 2300-2200 |

0.01 | 4 |

| US 2 Year Note (Decimal), Mar | 2300-2200 |

0.01 | 4 |

| US 5 Year Note (Decimal), Mar | 2300-2200 |

0.01 | 4 |

| US T-Bond (Decimal), Mar | 2300-2200 |

0.01 | 4 |

| US Ultra T-Bond (Decimal), Mar | 2200-2300 |

0.01 | 4 |

| Product | Min Stake | Min Stop Distance | G'teed Stop Premium | Min G'teed Stop Distance | |

|---|---|---|---|---|---|

| Bonds, Futures | |||||

| French OAT, Mar | 0.2 | 1 | 3.5 | 122 | |

| German Bobl, Mar | 0.2 | 10 | 3 | 120 | |

| German Bund, Mar | 0.2 | 2 | 3 | 128 | |

| German Buxl, Mar | 0.2 | 10 | 3 | 110 | |

| German Schatz, Mar | 0.5 | 10 | 3 | 110 | |

| Japanese Government Bond, Mar | 0 | 3 | 3 | 135 | |

| Long-Term BTP, Mar | 0.2 | 1 | N/A | N/A | |

| UK Long Gilt, Mar | 0.2 | 1 | 3 | 91.34 | |

| US 10 Year Note (Decimal), Mar | 0.2 | 1 | 3 | 46 | |

| US 2 Year Note (Decimal), Mar | 0.5 | 1 | 3 | 46 | |

| US 5 Year Note (Decimal), Mar | 0.5 | 1 | 3 | 46 | |

| US T-Bond (Decimal), Mar | 0.2 | 2 | 3 | 46 | |

| US Ultra T-Bond (Decimal), Mar | 0.2 | 1 | 3 | 46 | |

| Product | Contract Months | Last Day of Trading |

|---|---|---|

| Bonds, Futures | ||

| French OAT, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| German Bobl, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| German Bund, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| German Buxl, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| German Schatz, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| Japanese Government Bond, Mar | Mar, Jun, Sep, Dec | 06/03/2026 00:00:00 |

| Long-Term BTP, Mar | Mar, Jun, Sep, Dec | 05/03/2026 00:00:00 |

| UK Long Gilt, Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| US 10 Year Note (Decimal), Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| US 2 Year Note (Decimal), Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| US 5 Year Note (Decimal), Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| US T-Bond (Decimal), Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| US Ultra T-Bond (Decimal), Mar | Mar, Jun, Sep, Dec | 25/02/2026 00:00:00 |

| Product | Basis of Expiry Price | Daily Funding Premium* | NTR** Multiplier (Pro) | NTR** Multiplier (Retail) |

|---|---|---|---|---|

| Bonds, Futures | ||||

| French OAT, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| German Bobl, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| German Bund, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| German Buxl, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| German Schatz, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| Japanese Government Bond, Mar | SGX official settlement price on last day of trading +/- spread | N/A | 1.8% | 3.33% |

| Long-Term BTP, Mar | EUREX official settlement price on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| UK Long Gilt, Mar | EURONEXT LIFFE official settlement on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| US 10 Year Note (Decimal), Mar | CBOT official settlement on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| US 2 Year Note (Decimal), Mar | CME Official Closing Price +/- Spread | N/A | 0.3% | 3.33% |

| US 5 Year Note (Decimal), Mar | CBOT official settlement on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| US T-Bond (Decimal), Mar | CBOT official settlement on last day of trading +/- spread | N/A | 0.3% | 3.33% |

| US Ultra T-Bond (Decimal), Mar | CME Official Closing Price +/- Spread | N/A | 0.3% | 3.33% |

| Product | Trading Hours^ | Trade Per | Spread Width From*** |

|---|---|---|---|

| InterestRate, Futures | |||

| 3 Month Sonia, Dec 25 | 0730-1800 |

0.01 | 2 |

| 3 Month Sonia, Dec 26 | 0730-1800 |

0.01 | 2 |

| 3 Month Sonia, Jun 26 | 0730-1800 |

0.01 | 2 |

| 3 Month Sonia, Mar 26 | 0730-1800 |

0.01 | 2 |

| 3 Month Sonia, Sep 26 | 0730-1800 |

0.01 | 2 |

| Euribor, Jun 26 | 0100-2100 |

0.01 | 2 |

| Euribor, Mar 26 | 0100-2100 |

0.01 | 2 |

| Product | Min Stake | Min Stop Distance | G'teed Stop Premium | Min G'teed Stop Distance | |

|---|---|---|---|---|---|

| InterestRate, Futures | |||||

| 3 Month Sonia, Dec 25 | 0.5 | 1 | N/A | N/A | |

| 3 Month Sonia, Dec 26 | 0.5 | 1 | N/A | N/A | |

| 3 Month Sonia, Jun 26 | 0.5 | 1 | N/A | N/A | |

| 3 Month Sonia, Mar 26 | 0.5 | 1 | N/A | N/A | |

| 3 Month Sonia, Sep 26 | 0.5 | 1 | N/A | N/A | |

| Euribor, Jun 26 | 0.5 | 1 | N/A | N/A | |

| Euribor, Mar 26 | 0.5 | 1 | N/A | N/A | |

| Product | Contract Months | Last Day of Trading |

|---|---|---|

| InterestRate, Futures | ||

| 3 Month Sonia, Dec 25 | Mar, Jun, Sep, Dec | 16/03/2026 00:00:00 |

| 3 Month Sonia, Dec 26 | Mar, Jun, Sep, Dec | 15/03/2027 00:00:00 |

| 3 Month Sonia, Jun 26 | Mar, Jun, Sep, Dec | 14/09/2026 00:00:00 |

| 3 Month Sonia, Mar 26 | Mar, Jun, Sep, Dec | 15/06/2026 00:00:00 |

| 3 Month Sonia, Sep 26 | Mar, Jun, Sep, Dec | 14/12/2026 00:00:00 |

| Euribor, Jun 26 | Mar, Jun, Sep, Dec | 12/06/2026 00:00:00 |

| Euribor, Mar 26 | Mar, Jun, Sep, Dec | 13/03/2026 00:00:00 |

| Product | Basis of Expiry Price | Daily Funding Premium* | NTR** Multiplier (Pro) | NTR** Multiplier (Retail) |

|---|---|---|---|---|

| InterestRate, Futures | ||||

| 3 Month Sonia, Dec 25 | EURONEXT LIFFE official settlement | N/A | 0.3% | 20.0% |

| 3 Month Sonia, Dec 26 | EURONEXT LIFFE official settlement | N/A | 0.3% | 20.0% |

| 3 Month Sonia, Jun 26 | EURONEXT LIFFE official settlement | N/A | 0.3% | 20.0% |

| 3 Month Sonia, Mar 26 | EURONEXT LIFFE official settlement | N/A | 0.3% | 20.0% |

| 3 Month Sonia, Sep 26 | EURONEXT LIFFE official settlement | N/A | 0.3% | 20.0% |

| Euribor, Jun 26 | EURONEXT LIFFE official settlement price on last day of trading | N/A | 0.3% | 20.0% |

| Euribor, Mar 26 | EURONEXT LIFFE official settlement price on last day of trading | N/A | 0.3% | 20.0% |

^Please note that all markets close at 22:00 on a Friday and reopen from 22:00 on a Sunday as specified per individual market trading hours.

†Please note that to see specific expiry dates for certain markets, you need to log in to your account and then click on the 'i' button next to your chosen market. The specific expiry date for that product will be shown on the market information ticket.

*These products are continuously rolled overnight. For funding calculations see the Financial FAQs section on our website.

**NTR relates to Notional Trading Requirement (aka 'Initial Margin' and 'Deposit') and refers to the funds required as initial outlay for a trade. It is not the total amount that can be lost on the trade but the minimum amount you need to set aside to place a specific trade. NTRs vary from product to product, please see our Market Information Sheets above for specific details.

*** Spreads are subject to variation, especially in volatile market conditions. Our spreads will change during different times of the day and different market conditions to reflect the available liquidity in the underlying market that our price is based on. Larger trades may be subject to wider spreads, more information on this is displayed on the information button alongside each market on our platform.

Understand

how an INTEREST RATE spread bet WORKs

The price of the contract is always 100 minus the relevant interest rate.

Therefore if the 3 month Sonia quote was 98.5 it would represent an interest rate of 1.5%. Spread betting on this works the opposite way to spread betting on other financial instruments – if you thought rates were going to drop to 1% you would buy the quote with the expectation of the price moving to 99. If, on the other hand, you expected a rise in interest rates to 2% you would sell the quote with the expectation of the price moving to 98.

Since Bond prices rise when interest rates fall, you would buy these contracts if you expected the relevant interest rate to fall and sell if you expected rates to rise.

How to

go long and short in the same market

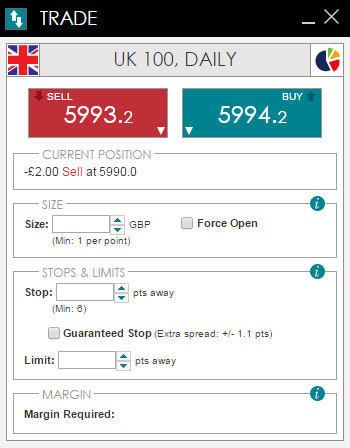

You are able to open a trade in the opposing direction to an existing trade in the same market, this is called a forced open trade. Rather than your positions netting off, you would now have open positions both long and short.

Forced open trades can be opened by placing a trade at the live available price or alternatively by adding an order to open at a different price, should the price subsequently move to the level of your order your forced open trade will be opened.

Forced open trades can be executed by ticking the forced open position on the deal ticket, you can also update your settings so the default setting is for forced open to always be selected.

It is important to note that placing forced open trades will result in increased costs. If you have forced open positions open overnight, the funding adjustments will be applied to all positions open and will lead to increased funding costs. These costs can be avoided by not placing forced open trades and just allowing your positions to net off eg. £10 long position and £10 short position = no net overall exposure.

how to

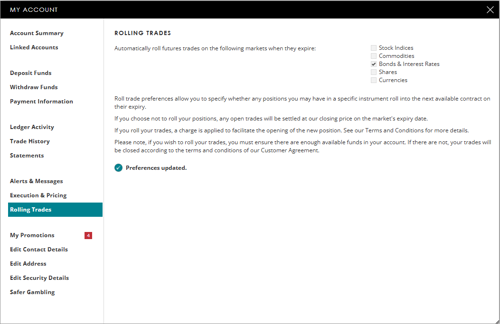

roll a Bond or Interest rate trade

Futures trades will close at the expiry date of the contract. You can specify whether you would like to roll any futures trades to roll into the next contract by visiting the Rolling Trades page within My Account once you have logged in. Click the following link to find out information on setting your Trading Preferences. You can find the expiry date of each futures contract on the information button on our platform.

When you first open the account, as a default setting, all preferences are set for trades not to roll. If you wish for your trades to roll past their respective expiry dates it is essential that you have updated these preferences.

If you would like to roll all Bond & Interest Rate trades, please ensure that the ‘Bond & Interest Rate’ box is ticked, as shown in the above example

Any stops or limits you have attached to your trade will be rolled over also, they will be adjusted to reflect the price of the new contract you have been rolled into.

HOW TO work out the

NTR/Margin for A Bond or interest rate trade

The Notional Trading Requirement (NTR, Initial Margin or Margin) is the amount of money we require for you to open a trade in a specified product. The NTR will normally be displayed as a percentage and can be found in the Bonds and Interest Rates Market Information | Spreadex

For example, placing a £10 trade on the UK Long Gilt at 91.70 would require £3,056.63 of NTR, as the NTR rate is 3.33% (£10 x 9170 x 3.33%).

The majority of markets will have a larger NTR rate for larger stake sizes. This is to reflect the increased risk of larger positions, we require a greater deposit the bigger the position size. The NTR tiers can be found on the information button alongside each market on our platform. The NTR tiers don't act as a cliff edge, they act as a step system where the NTR margin rate for each tier is applied against your position.

For example, if the UK Long Gilt has tiered margin catergories of 3.33% up to a stake of £500 and 15% above £500 and your stake was £505, only £5 of your position would be margined at 15%.

If you have a ‘Force Open’ position or an opposing trade in both the futures and daily you will only be charged NTR on the trade with the larger stake.

how to

VIEW MORE INFORMATION ON BONDS AND INTEREST RATES

You can find full details on our bonds and interest rate markets, including trading hours, spread widths, minimum stop distances and stake levels, contract months, expiries, rolls and NTR information via our Bonds and Interest Rates Market Information Pages.

Find out more on

UK Long Gilts

UK Long Gilts are government-backed bonds issued by the Debt Management Office in the UK, and are named so because the original certificates had gilded edges.

You can place a financial spread bet on Long Gilt futures with Spreadex to speculate on the movement of long-term interest rates (which is different from the bank base rate).

It is important to understand the inverse relationship between bond prices and yields. As bond prices rise, long term interest rates will fall.

When placing a financial spread bet on bonds, you would place a ‘buy’ trade on Long Gilt futures if you think rates will fall and a ‘sell’ trade on Long Gilt futures if you expected rates to rise.

In general terms, government bonds are lesser known products when it comes to financial spread betting but they can still attract plenty of interest, especially in uncertain economic times with the collapse of the financial markets and interest rates, for example.

find out more on

us 10 year note

US Treasury notes are US bonds with a remaining term to maturity of between six and a half years and 10 years, from the first day of the delivery month.

With Spreadex, you are trading on the 10 Year note futures and spread bets are placed in movements of £1 per 1/32 of a point.

It is important to understand the inverse relationship between bond prices and yields. As prices rise, rates fall.

When placing a financial spread bet on bonds, you would place a ‘buy’ trade on the 10 Year Note future if you think rates will fall and a ‘sell’ trade on the 10 Year Note future if you expected rates to rise. It is important to note that you are trading on long-term interest rates rather than bank base rates.

In general terms, government bonds are lesser known products when it comes to financial spread betting but they can still attract plenty of interest, especially in uncertain economic times with the collapse of the financial markets and interest rates, for example.

find out more on

us t-bond

This US bond has a maturity of 10-30 years, but is otherwise very similar to the Treasury Note.

A spread bet with Spreadex on the future of this bond is based on price movements in increments of 1/32 of a point.

30 year fixed-interest securities generally experience more volatility than the 10 year counterpart. Since bond prices rise when rates fall, in spread betting you would place a ‘buy’ trade on the T-Bond future if you expected long term rates in the US to fall and a ‘sell’ trade on the T-Bond future if you expected long term rates to rise.

It is important to note that you are trading on long-term interest rates rather than bank base rates.

In general terms, government bonds are lesser known products when it comes to financial spread betting but they can still attract plenty of interest, especially in uncertain economic times with the collapse of the financial markets and interest rates, for example.

find out more on

The German Bund

The German Bund is a fixed-interest security issued by the German government to finance its debt, but is often seen as the benchmark contract for all euro-denominated government debt.

The Spreadex market is a future on the Bund, which allows you to place a spread bet on the direction of long term interest rates in Germany for hedging or speculative purposes.

Since bond prices rise when rates fall, you would place a ‘buy’ trade on Bund futures if you expected the rate to fall and a ‘sell’ trade on Bund futures if you expected rates to rise. It is important to note that you are trading on long-term interest rates rather than bank base rates.

In general terms, government bonds are lesser known products when it comes to financial spread betting but they can still attract plenty of interest, especially in uncertain economic times with the collapse of the financial markets and interest rates, for example.

find out more on

Euribor

The Euro Interbank Offered Rate, or Euribor, is a daily reference rate based on the average rates at which banks offer to lend unsecured funds to other banks in the euro wholesale money market.

This rate can differ from the base rate. Placing a financial spread bet on a short-term interest rate may seem counterintuitive at first, as the price of the contract is 100 minus the interest rate.

For example, an interest rate of 2.5% will make a price of 97.5. If you thought interest rates would rise, then you would place a ‘sell’ spread bet on the Euribor 3-month future. Likewise, you would place a ‘buy’ spread bet on the Euribor 3-month future if you thought interest rates would fall.

find out more on

short sterling

This market is based on the London Interbank Offered Rate (LIBOR) which is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the London wholesale money market.

This rate can differ from the base rate. Placing a financial spread bet on a short-term interest rate may seem counterintuitive at first, as the price of the contract is 100 minus the interest rate.

For example, an interest rate of 2.5% will make a price of 97.5. If you thought interest rates would rise, then you would place a ‘sell’ spread bet on the Short Sterling 3-month future. Likewise, you would place a ‘buy’ spread bet on the Short Sterling 3-month future if you thought interest rates would fall

find out more on

eurodollar

Eurodollar refers to all deposits denominated in US dollars and held in banks anywhere outside the United States, not just Europe.

The 3 month Eurodollar rate is a daily reference rate based on the average interest rates at which non US banks offer to lend unsecured US dollars to other banks in the global money market.

This rate can differ from the base rate. Spread betting on a short-term interest rate may seem counterintuitive at first, as the price of the contract is 100 minus the interest rate.

For example, an interest rate of 2.5% will make a price of 97.5. If you thought interest rates would rise, then you would place a ‘sell’ spread bet on the Eurodollar 3-month future. Likewise, you would place a ‘buy’ spread bet on the Eurodollar 3-month future if you thought interest rates would fall.