How to

Calculate funding charges for a daily rolling trade

If you hold a rolling trade overnight, your trade will be kept open for the following day's trading and a funding charge will be levied on your account. The funding charge could be a debit or a credit depending on if your position is short or long.

Funding is charged to reflect the cost of financing a position that you hold having only put down a fraction of the value as a deposit.

The funding charge is based on the Adjusted ARR + a Spreadex Charge per annum. For FTSE 350 stocks the charge is 3%. Therefore if the Adjusted ARR was 4%, the total daily funding charge to a long position would be (4% + 3%) / 365 = 0.019% of the total position value. The total position value can be calculated by mutliplying your stake with the price of the market.

For Example: You hold a long (buy) position in Barclays of £50 and it closes the day at 200p, your funding charge for the night would be (50x200) x 0.019% = £1.92.

If you are short, the 3% charge is subtracted from the Adjusted ARR rate. Unlike long positions, the total funding adjustment on short positions can result in either a positive or negative funding adjustment, so your account can be credited or debited funding. If the Adjusted ARR is greater than the 3% charge, the funding adjustment will be positive and credited to your account. If the Adjusted ARR is less than the 3% charge, the funding adjustment will be negative and debited from your account.

For Example: If the Adjusted ARR was 0.5% and you hold a short position in Barclays of £50 and it closes the day at 200p, your funding charge for the night would be (50 x 200) x((0.5% - 3%) / 365) = £0.68

For Example: if the Adjusted ARR was 5% and you hold a short position in Barclays of £50 and it closes the day at 200p, you would be credited funding for the night of (50 x 200) x ((5% - 3%) / 365) = £0.55

The funding is trebled for positions held overnight on Friday to account for holding a trade over the weekend, and bank holidays will be similarly charged.

Understanding

ADJUSTED ALTERNATIVE REFERENCE RATES

Following the phasing out of IBOR rates, 1 month Alternative Reference Rates (ARRs) are used in funding calculations. ARRs are based on actual overnight interest rates in liquid wholesale cash and derivative markets.

An ARR is a new type of interest rate used in financial products like loans and mortgages. It replaces older rates like LIBOR, which were based on estimates from banks and became unreliable.

The applicable ARR will be based on the currency in which the underlying market trades:

|

Currency |

ARR |

|

GBP |

SONIA |

|

EUR |

ESTR |

|

USD |

SOFR |

|

CHF |

SARON |

|

JPY |

TONA |

Unlike IBOR rates, ARRs do not incorporate credit risk. To compensate for this, we adjust the ARRs based on the one-month spread adjustment proposed by the International Swaps and Derivatives Association (ISDA).

How to

rolling a quarterly tradE

Click the following link to find out information on setting your Trading Preferences.

Quarterly trades will be automatically rolled by us during the final trading day of the existing contract, if you have indicated to us you wish for this to happen via your roll preferences. Should you wish to roll your position before this date then you may do so by contacting our dealers. You can find the expiry date of each futures contract on the information button on our platform.

When being rolled, your closing price on the expiring contract will be the previous night’s closing bid if you are long or offer if you are short. The opening price in the next quarterly contract will be the previous night’s bid if you are short or the offer if you are long.

If you wish to be rolled into the far futures contract or at a price other than the previous night’s close* then please call our financial traders on 08000 526 570.

If you decide to allow your trade to expire we will close your position at the closing Spreadex bid or offer price on the day of expiry. Please note if your position is of a certain size we may force roll your position to ensure we can close the postion in an orderly way.

How to

go long and short in the same market

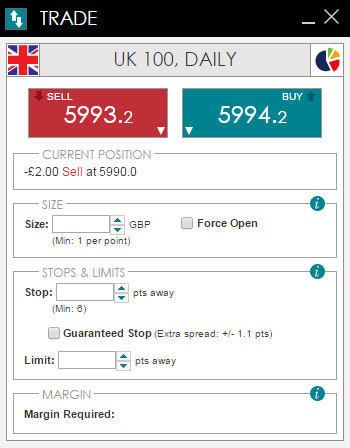

You are able to open a trade in the opposing direction to an existing trade in the same market, this is called a forced open trade. Rather than your positions netting off, you would now have open positions both long and short.

Forced open trades can be opened by placing a trade at the live available price or alternatively by adding an order to open at a different price, should the price subsequently move to the level of your order your forced open trade will be opened.

Forced open trades can be executed by ticking the forced open position on the deal ticket, you can also update your settings so the default setting is for forced open to always be selected.

It is important to note that placing forced open trades will result in increased costs. If you have forced open positions open overnight, the funding adjustments will be applied to all positions open and will lead to increased funding costs. These costs can be avoided by not placing forced open trades and just allowing your positions to net off eg. £10 long position and £10 short position = no net overall exposure.

How to calculate

Funding charges for a quarterly bet

As with a daily rolling bet funding is charged as a percentage over the Adjusted ARR. There are three quarterly contracts available to trade at any one time and they are priced off 3 month, 6 month and 9 month Adjusted ARR respectively from opening.

To work out the funding charge for a quarterly contract you take the days left in the contract and divide by 365 and multiply that by the interest rate.

For Example: You are looking at a Barclays contract which expires on 20th March. The date today is the 24th January. The days remaining in the contract are 57. The contract is now being priced off three-month Adjusted ARR which is at 0.8890%. As Barclays is in the FTSE 100, it is priced at 2% over Adjusted ARR,* so the total interest charge is 2.8890%. Barclays is trading at 215p.

Therefore the funding payable on the position is 57/365 x 2.8890% x 215 = 0.97.

When added to the cash price (ie. 215.97) this is often referred to as the Fair Futures Price.

*This charge is reflective of Spreadex charges and may not represent the actual charge. For up to date charges please contact our trading desk on 08000 526 570.

FIND out more on

short borrow charges

When shorting (selling a stock that you do not hold a long position on) you may incur a ‘borrowing charge’. For stocks that can be shorted in the underlying market, this borrowing charge will be the applicable rate in the underlying market plus a reasonable charge. If there is no underlying borrow available in the stock, we may still allow you to place a down Bet against our overall long book exposure if we judge that we have sufficient customers who are long. In such a case, the cost of borrowing will be higher to reflect the lack of availability in the underlying market and typically the charge will be 10% of the value of the stock per annum, but could be higher and we will be entitled to charge any rate that is not commercially unreasonable. Please note however, that borrowing charges relating to open bets may vary with little or no notice as the underlying market rate changes and/or our overall book changes. To determine whether a Borrowing Charge applies, call our traders in advance of placing the Spread Bet and we will advise on the applicable rate. The borrowing charge (if applicable) will be accounted for in a daily cash adjustment applied to your account. Where shares are called back (ie. the ability to borrow no longer exists) we will close your position at the prevailing market price. The borrowing charge and the ability to go short, can change at short or no notice. Borrowing charges can also be levied at any point during the life of your open bet and not just on opening.

FIND out more on

UNDERSTANDing NTR/MARGIN

The Notional Trading Requirement (NTR, Initial Margin or Margin) is the amount of money we require for you to open a trade in a specified product. The NTR will normally be displayed as a percentage and may vary from product to product, please check using this link for specific details on a stock.

The majority of markets will have a larger NTR rate for larger stake sizes. This is to reflect the increased risk of larger positions, we require a greater deposit the bigger the position size. The NTR tiers can be found on the information button alongside each market on our platform. The NTR tiers don't act as a cliff edge, they act as a step system where the NTR for each tier is applied against your position.

For example, if Nvidia has tiered margin catergories of 20% up to a stake of £10 and 40% above £10 and your stake was £11, only £1 of your position would be margined at 40%.

If you have a ‘Force Open’ position or an opposing trade in both the futures and daily you will only be charged NTR on the trade with the larger stake.

FIND out more on

WHY SPREADS VARY FROM SHARE TO SHARE

Our share spreads are calculated as a percentage of the current price of the share and are added to either side of the underlying market cash spread. Therefore as the spread in the underlying market varies so too does our spread.

FIND out more on

dividend adjustments

All things being equal, when a company pays a dividend to its shareholders, the value of the share price should fall by the same amount as the dividend paid.

If you hold a position in a stock through the close of the underlying cash market on the day before the ex-date, a cash adjustment will be made on your account that evening to reflect the dividend being paid.

If you are long (have bought) a stock, the dividend adjustment will be credited to your account.

If you are short (have sold) a stock, the dividend adjustment will be debited from your account.

In some circumstances we will pay the dividend the day after the ex-date (typically this occurs with small cap stocks). This will be done via an appropriate cash adjustment on the account.

Dividends can be subject to withholding tax. This is simply a charge passed on and not levied by us. Withholding tax rates do vary from country to country. If you would like to know the withholding rate for a dividend please call one of our financial traders on 08000 526 570.

Please be aware that all of the above details are for guidance only. Subject to the details of any Corporate Action your position may be treated and adjusted in a different manner and we will inform clients as soon as is reasonably practical.

FIND out more on

closing only markets

When a share contract is displayed as closing only, in the majority of cases this will be due to our company’s limit being reached or a client’s individual risk limit being breached.

If you see this message then please call our financial traders on 08000 526 570 as it may be possible to offer an opening trade in the stock, albeit most likely in a smaller size and a higher NTR/margin rate.

FIND out more on

buy only markets

You will see this message when you are unable to go short (sell) a share. This would occur if there is no available borrow in the underlying cash market or if there is a short selling ban implemented by the relevant country.

If you already hold a long (buy) position in the stock you would be able to sell to close.

FIND out more on

Stock AFFECTED BY A Corporate Action

Although you do not own shares when taking out a spread bet, we will, whenever possible, replicate what occurs in the market should you hold the physical stock, so that your exposure remains the same as it was before the Corporate Action.

Open Offer

An open offer is where a shareholder is given the opportunity to purchase stock at a price that is lower than the current market price. The purpose of such an offer is to raise cash for the company.

At a point on or just after the ex-date we will inform you of the terms of the offer and advise you of any deadline with regards to making a decision as to whether you would like to take up the offer. If you let the offer lapse there will be no change to your position. If you take up the offer, a separate position will be booked as per the terms of the offer in the same contract as you hold the original position. This will be booked at the fair futures premium of the subscription price with no additional spread charged by us.

If you are short (sell) a stock that is subject to an open offer, you will not have any option and risk being taken up against if all the long (buy) holders take up their offer. You will again find a separate short (sell) position booked on your account as per the terms of the offer in the same contract as you hold the original position. Again, this will be booked at the fair futures premium of the subscription price with no additional spread charged by us.

Rights Issue

These are the issue of rights to a company’s existing shareholders to buy a proportional number of additional shares at a given price (usually a discount) with a set period. Rights are often transferable, enabling a holder to sell them on the open market

On the ex-date, the rights will get booked to your account as a separate position under a new line (if you have a position in Barclays, the rights will be booked under Barclays NP) at an opening level of zero. We will contact you to advise you of this and of the timetable and deadline involved with the rights issue.*

If you are long (buy) you will have the option to take up the rights, trade out of them (if they are tradable) or let the rights lapse.

If you are short (sell) you risk being taken up against, or you may buy the rights back (if they are tradable).

If you take up the rights, or have them taken up against you, on the pay date of the rights issue, your rights position will expire at zero and a new position will be booked on your account in the underlying share, in the same contract period as your original position. Your opening level will reflect the fair futures premium of the subscription price of the rights issue.

Stock Split

This is where a company’s existing shares are divided into multiple shares and as a result the share price falls by the same ratio. The total value of the shares therefore, remains the same. A common reason for stock splits is that a company’s share price has grown so high that many investors find it too expensive to buy in.

By the same token a Reverse Stock Split reduces the number of shares in circulation but increases the share price. If you have a position in a company that enters a stock split, your original position will be closed at entry level to ensure no profit or loss is realised. A new position will then be opened in the same contract to reflect the ration of the split.

Tender Offer

This is an offer to purchase some or all of the shareholders’ shares in a company. The price offered is generally at a premium to the market price.

We will contact you with the terms of the tender offer and the timetable for it. At or close to the deadline we will again endeavour to contact you to receive your instructions.* If you accept the tender offer, we will close your position at the fair futures premium of the tender price. If you choose not to take up the offer and where the offer has not become conditional, your position will remain unchanged.

*We will always endeavour to contact you with regard to receiving your instructions on any Corporate Action. However, it is always your responsibility to inform us of your intentions. Failure to do so will result in the default action being applied to your account.

This is not an exhaustive list of potential Corporate Actions. We will always inform of any other actions that your position may be subject to and will, where necessary, take guidance from our brokers to reflect in your position what would occur should you actually hold the physical stock.

Please be aware that all of the above details are for guidance only. Subject to the details of any Corporate Action your position may be treated and adjusted in a different manner and we will inform clients as soon as is reasonably practical.

Our financial traders are available to answer any questions you may have relating to Corporate Actions on 08000 526 570.

FIND out more on

SHARes IN A MARKET AUCTION

Market auctions occur if the price of a share moves significantly from the previous night’s closing price or from a previous auction price intraday. When the share goes into auction it is not possible to buy or sell a share. Generally you can tell if a share is in auction if the bid price is greater than the offer price although this is not always the case. If you try and place a bet online when a share is in auction, your request will be rejected.

Auctions also occur at the start and close of each trading day (07.50 – 08.00 and 16.30 – 16.35) and at midday (12:00). There is no online trading during this period, however, you may phone in to place an order during the auction period.

FIND out more on

phone trade only shares

Some Market Maker stocks are displayed as phone only due to the lack of liquidity typical in these shares and our need to often check with the market as to the actual price being bid or offered. Where we do not have a live feed in some of our non-UK stocks you will find these displayed as phone only. To trade these, simply call our financial traders on 08000 526 570 and we will be able to provide you with a live quote.

From time to time we may place other shares temporarily on phone only. If you are looking to place a bet on them then just call our financial traders on 08000 526 570.

FIND out more on

trading non-UK stockS

All spread bets are denominated in the currency of your account. You place a stake per point movement, where the "stake" represents the amount you're willing to risk for each point the market moves.

For example, if Nvidia is trading at 18,000, and your stake is 1 per point long, a 10 point increase in the price, 18,010 would result in a profit of 10 in your account currency.

CFDs are traded in the number of contracts. Your profit and loss are calculated in your account's base currency which will fluctuate with FX changes.

Example, you buy 5 CFDs of Nvidia at 18,000 cents valued at $900, then the price increases to 18,010 cents. Your position is now worth $900.50, making $0.50 in profit. For a GBP account, this will appear as +£0.37 based on an exchange rate of 1.337.

Click the following link for more information on CFDs vs spread bets

FIND out more on

PRE AND POST MARKET SESSIONS

For a selection of US Stocks we offer clients the ability to trade these online during the pre and post market sessions offered by the underlying exchanges (outside of normal market hours). You can identify which stocks this is available on by checking if they have the text (All Sessions) after their name, e.g. Apple (All Sessions). Although the ability to trade on longer exchange times offers many benefits, such as being able to react to stock specific and broader market news quicker, or being able to trade during earnings announcements, trading outside of the main exchange times can also cause bid/offer quotes to widen in times of less liquidity in the underlying product. This could affect the spread quoted by Spreadex or cause any stop or limit you may have working to trigger.

FIND out more on

uk 100 shares

UK 100 Shares are the 100 most highly capitalised firms listed on the London Stock Exchange and include the likes of Barclays, Marks & Spencer, J Sainsbury and Rio Tinto.

These stocks collectively make up the FTSE 100 index. Because of the nature of the these companies you will often find more favourable margin rates and spread widths when placing a financial spread bet on a UK 100 share.

FIND out more on

UK 250 Shares

UK 250 shares are 250 mid capitalised markets listed on the London Stock Exchange and include the likes of Wizz air, ITV and Burberry Group .

These stocks collectively make up the FTSE 250 index and, in addition to the FTSE 100 stocks, form the FTSE 350 index. UK 250 stocks are liquid stocks and while not offering as favourable margin rates or spread widths as UK 100 stocks, can still provide good value in terms of financial spread betting.

FIND out more on

uk non-350 shares

UK non-350 Shares are small cap stocks listed outside the 350 companies in the UK 350 index. Most are listed on the Alternative Investment Market (AIM) and include the likes of Sound Energy, Sirius Minerals and ASOS.

Small cap or AIM stock listed shares are typically far less liquid than UK 350 companies and can often be more expensive to trade on in relation to financial spread betting. However, Spreadex is known for its specialist small cap coverage and has some of the lowest margin rates in the industry for AIM stock spread betting.

FIND out more on

shares with less than £10m market cap

Shares with a market capitalisation of less than £10m are stocks which tend to be fairly illiquid and are generally companies on which it is difficult to obtain detailed information.

It can often be expensive to spread bet on these types of companies. Indeed most spread betting companies will not offer spreads on stocks with a market capitalisation of less than £10m – sometimes even higher.

Spreadex is known for its specialist small cap provision and you can spread bet on shares with a market capitalisation as low as £1m.

FIND out more on

us shares

At Spreadex you can spread bet on all major US shares, including those listed in the S&P 500, NASDAQ 100 and the DOW Jones. Some of the familiar names listed among our US shares include Alphabet (Google), Apple, Boeing, General Electric and JP Morgan Chase.

If you want to bet on a share that is not listed on our website, please call our financial room on 08000 526 570 and we will do our best to accommodate your request.

FIND out more on

euro shares

At Spreadex you can spread bet on all major European shares, including those listed on the DAX, CAC, Swiss Index and Euro Stoxx 50. Some of the familiar names listed among our European stocks include Banco Santander, Nokia, Philips and Unilever.

If you want to bet on a share that is not listed on our website, please call our financial room on 08000 526 570 and we will do our best to accommodate your request.