Financial Trading Blog

Eurozone Inflation Expected to Stay Stable

The EU is expected to continue projecting an image of stability, with the release of data this week confirming that inflation is on target, leaving the ECB with little to do policy-wise.

The Key Data Points

- Eurozone December inflation is expected to return to the 2.0% target, down from 2.1% in November.

- Markets expect the ECB to remain on the sidelines in the coming months, as long as data meet current forecasts.

- Internal deliberations at the ECB come into focus amid elections for top posts in the Executive Board as more Eastern European countries join the euro.

On Target and Unchanged

European markets are gearing up for the new year with the release of key CPI figures for December on Wednesday, the first significant data that could shake up the markets since the holidays. Analysts' consensus is that December Eurozone inflation will retreat to 2.0% from 2.1% in November, matching the ECB's target. The core rate is projected to remain unchanged at 2.4%. Investors will be closely watching the services sector, as President Christine Lagarde singled out inflation in that sector as a concern at the last policy decision in September.

If expectations are met, it would imply that the Eurozone economy is maintaining its expected slow-growth, low-inflation trajectory, with economists projecting that the central bank will keep rates unchanged this year. At the last policy meeting, the ECB upgraded its 2026 GDP growth outlook, which convinced markets that it would not be easing further. However, manufacturing PMI figures disappointed last Friday, falling to a 9-month low of 48.8 and below the 50 level that separates growth from contraction. Some analysts warned that the slowdown in European manufacturing could mean that the upgraded growth projections might not be met. The euro was on the back foot on Monday after the data release, amid geopolitical tensions that supported the dollar, but the EURUSD still managed to close in the green after Fed Kashkari’s dovish comments.

What's Next for the ECB and Euro?

Officials at the ECB have been largely silent during the holiday period, providing the market with little in the way of updated guidance. However, that doesn't mean things have been quiet on the monetary policy front. Bulgaria is the latest country to join the Eurozone, having officially adopted the euro on January 1st. The country has been facing political turmoil since the government resigned in mid-December amid anti-corruption protests, and Bulgarians are heading to the polls for the eighth time in five years. Questions about transparency were also on the agenda after an FT report alleged that Lagarde's salary was much higher than the ECB had disclosed.

Bulgaria's accession to the euro comes amid the election of a new Vice President to succeed Spain's Luis de Guindos, whose term ends in May. Eastern nations have renewed pressure for greater representation on the executive council, which could add another dimension to the often-strained negotiations to fill the top positions at the ECB. With the ECB largely expected to keep rates unchanged, internal deliberations and their implications for the dove-hawk split could carry more weight for the currency in the coming months.

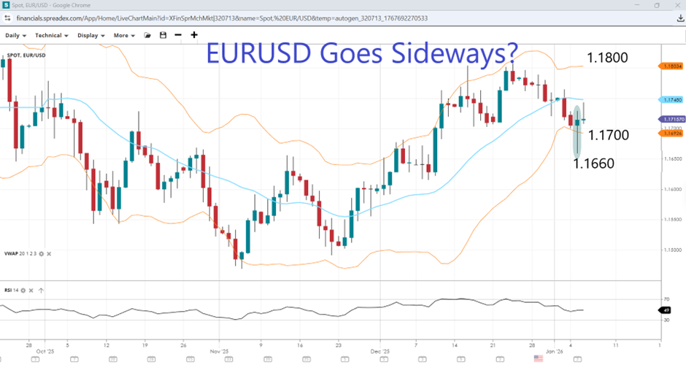

EURUSD Pinbar Brings 1.1800 Into Focus

EURUSD witnessed a rejection at the lower VWAP, which coincided with the 1.1700 handle, leaving behind a pinbar. With prices contained between here and 1.1800, a potential consolidation could be in the making. If bulls can reclaim the flattened middle VWAP at 1.1748, it could open the door to the upper zone. Meanwhile, further weakness could see the bottom VWAP support give way to bears, exposing the Monday bottom at 1.1660 once again, as the RSI sits right in the middle.

Source: SpreadEx, ERUSUD Daily Chart

It's easy to open an account

- Fill in our simple online application form

- Fund your account

- Start trading the global markets instantly!

SEARCH FOR AN ARTICLE:

Enter a keyword and search for all relevant articlesMARKET ANALYSIS

RECENT POSTS

DISCLAIMER

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investors lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. For professional clients, spread betting and CFD trading can also result in losses larger than your initial stake or deposit.

Spreadex Ltd is authorised and regulated by the Financial Conduct Authority, provides an execution only service and does not provide advice in any way. Nothing within this update should be deemed to constitute the provision of investment advice, recommendations, any other professional advice in any way, or a record of our trading prices. This update does not constitute or form part of an offer of, or solicitation for a transaction in any financial instrument, nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore. Any persons placing trades based on their interpretation of the comments or information within this update does so entirely at their own risk.

No representation, warranty, or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained within this update by Spreadex Ltd or any of its employees and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. As such, no reliance may be placed for any purpose on the information and opinions contained within this update.

The information contained within this update is the intellectual property of Spreadex Ltd and is protected by UK and International copyright laws. All rights reserved. Users may however freely download, distribute and reproduce extracts of the contents, subject always to accrediting Spreadex Ltd as the source and providing a hyperlink to www.spreadex.com.